Authorised and regulated by

the Financial Conduct Authority

Non-fault car accident? By calling us first you could save on average £539*

- No excess to pay - average saving £348*

- Like-for-like replacement vehicle

- Lifetime guarantee with repairs*

- 24/7 National roadside recovery

- We fight to win liability in your favour

After an accident, most think to call their insurer.

We're changing our clients minds, here's why...

No excess

to pay

Did you know insurers normally charge your excess, even when the accident wasn’t your fault?

We NEVER charge an excess!

Like-for-like replacementvehicle

Insurers will normally provide you with a small replacement vehicle as a courtesy car.

We WOULD provide you with a like-for-like!

All new parts used

in repairs*

Most large insurers use green parts (second-hand/recycled) when repairing your vehicle.

We use NEW, manufacturer approved, parts!

24/7, 365 UK wide roadside recovery

Recovery can be an optional extra when taking out your insurance policy, so you may not be covered.

We provide year-round recovery to ALL of our customers!

We fight to win liability in your favour

Sometimes, insurers often settle claims on a 50-50 basis, rather than arguing liability.

We will FIGHT the case on your side!

Dedicated claims handler & live updates

Insurers rarely have dedicated file handlers, which can be very frustrating.

We have DEDICATED file handlers to support you from start to finish!

Auto Claims Line vs your insurance companies.

There’s no contest.

From the moment you get in touch to the conclusion of your claim, we’re committed to providing you with a service that your insurance company can’t match. And as long as you weren’t at fault, it’s completely free – here’s why:

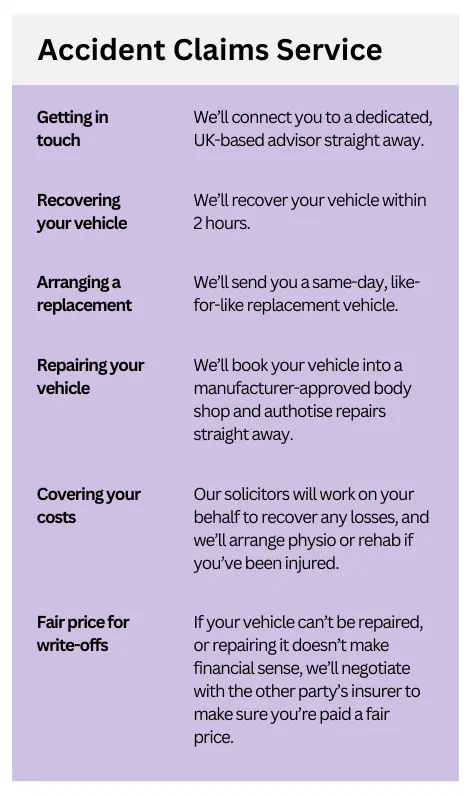

Accident Claims Service

Getting in

touch

We’ll connect you to a dedicated, UK-

based advisor straight away.

Recovering

your vehicle

We’ll recover your vehicle within 2

hours.

Arranging a

replacement

We’ll send you a same-day, like-for-like replacement vehicle.

Repairing your vehicle

We’ll book your vehicle into a manufacturer-approved bodyshop and authorise repairs straight away.

Covering your costs

Our solicitors will work on your behalf to recover any losses, and we’ll arrange physio or rehab if you’ve been injured.

Fair price for

write-offs

If your vehicle can’t be repaired, or repairing it doesn’t make financial sense, we’ll negotiate with the other party’s insurers to make sure you’re paid a fair price.

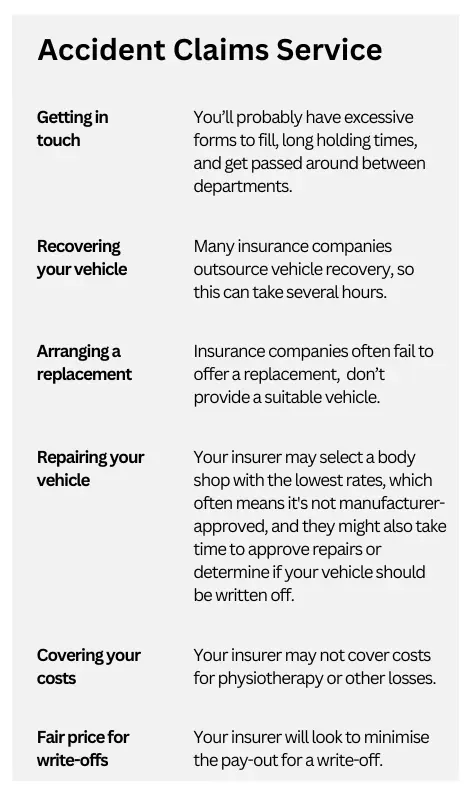

Insurance Companies

Getting in

touch

You’ll probably have annoying forms to fill, be kept waiting on hold, and get passed around between departments.

Recovering

your vehicle

Many insurance companies outsource vehicle recovery, so this can take several hours.

Arranging a replacement

Insurance companies often fail to offer a replacement, or don’t provide a suitable vehicle.

Repairing your vehicle

Your insurer may select a body shop with the lowest rates, which often means it's not manufacturer-approved, and they might also take time to approve repairs or determine if your vehicle should be written off.

Covering your costs

Your insurer may not cover costs for physio or other losses.

Fair price for

write-offs

Your insurer will look to minimise the pay-out for a write-off.

We’ve already helped thousandsof people who were involved in non-fault accidents, saving them time, money and hassle.

We can help you too

Auto Claims Line vs your insurance companies.

There’s no contest.

From the moment you get in touch to the conclusion of your claim, we’re committed to providing you with a service that your insurance company can’t match. And as long as you weren’t at fault, it’s completely free – here’s why:

We’ve already helped thousandsof people who were involved in non-fault accidents, saving them time,money and hassel

We can help you too.